On the 2nd June, 2025, ep hosted the Financing the Future: Powering Local Net Zero Action with Private Capital roundtable. This event, held in Bryan Cave Leighton Paisner (BCLP)’s London office, was supported under our Innovate UK (IUK) funded Shift to Net Zero project with project partners Ibex Earth and Surrey County Council. The event brought together stakeholders across the private finance sector including legal, insurance, retail banking and asset management, along with directors at Surrey and West Sussex Councils.

The aims of the roundtable were:

- To identify attractive asset classes for each investor type

- To explore blended finance mechanisms

- To understand investment criteria for place-based investment

- To establish interest in and parameters for investment via an NZDV model

Steven Fawkes opened up the roundtable by discussing how we are all increasingly affected by climate change, and while the solutions are well understood, the challenge lies in directing investment away from fossil fuels and into clean technologies. EP is focused on accelerating this transition through its various companies: EP Consultancy (supporting organisations navigate the energy transition and net zero), EP Architects (specialising in low energy, sustainable retrofit) and EP Impact (raising capital for energy transition companies and projects).

Steven also spoke about how Local Authorities (LAs) are central to achieving net zero, yet often face the widest investment barriers, including a lack of development expertise and limited access to private finance.

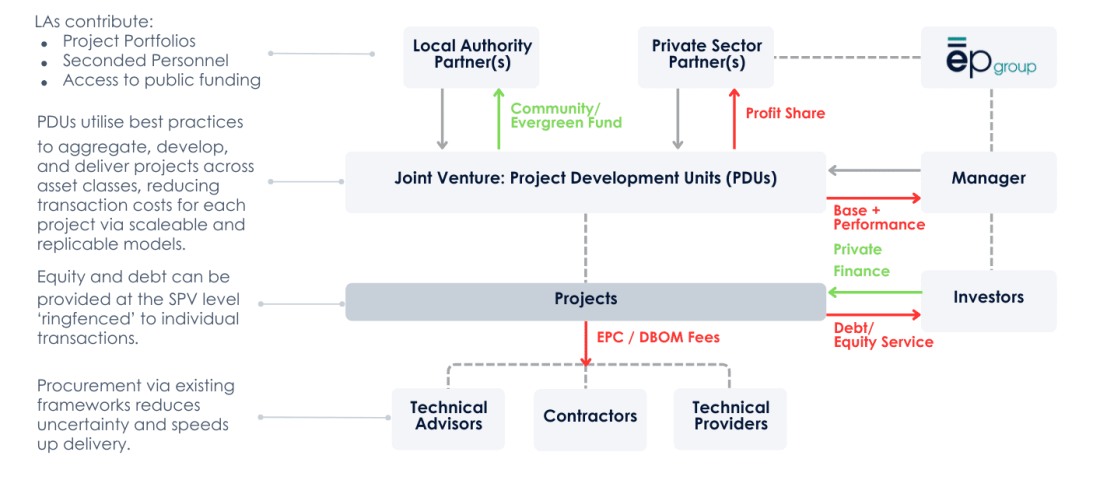

Leo Bedford spoke about the Net Zero Delivery Vehicle (NZDV) as a solution to bridging these barriers. This model is designed to be a public-private partnership that brings together local authority project opportunities and capabilities, with private sector development expertise in order to attract capital investment. The structure aims to be equitable between the public and private sector, meeting the private sector investment criteria with public sector projects through standardisation, aggregation and quality assurance.

The Net Zero Delivery Vehicle Structure

The NZDV structure received strong backing from institutional investors at the roundtable, many of whom confirmed they are ready to invest in fully developed, quality-assured net zero projects. These investors have mandates to support energy efficiency and renewable energy schemes. They recognise that the NZDV’s ability to aggregate diverse project types could build scale and diversify risk. This shift—from isolated £10m projects to a consolidated £100m investment pipeline—was seen as a critical factor in making net zero infrastructure more appealing to commercial lenders.

Key Takeaways from the Summit:

Skills Gap: There is a lack of both development and technical implementation skills within LAs. The NZDV can bridge this gap.

Scale is necessary: Development of an investment-ready project pipeline at scale is needed to mobilise institutional capital. The NZDV aggregates projects to build this scale.

<strong data-start="679" data-end="706" Collaboration Matters: Bringing LAs and the finance sector together helps bridge communication gaps. This can be done through a centralised hub, such as the NZDV.

Phased Approach: The transition to net zero is complex. We cannot achieve everything immediately. The NZDV focuses on achievable, place based projects at scale that can move us towards net zero.

Need for mandated roles: LAs need a defined role in delivering net zero, with clear national direction, especially through devolution. The NZDV can facilitate the dialogue required to move this forward.

Clear Messaging: Avoid evangelical language around net zero. The NZDV focuses on the value stack of projects, helping stakeholders understand the multiple benefits of net zero projects beyond just energy savings.

There is strong interest among funders to invest in place-based projects, and while many valuable conversations happen at events like these, the NZDV aims to move beyond dialogue to delivery. It is designed to serve as a central hub—capturing best practices from local authorities and uniting fragmented efforts into a shared, knowledge-led platform. By translating local opportunity sets into a coherent investment narrative for funders—and communicating that back to local authority leadership—the NZDV acts as a vital bridge between public ambition and private capital. Darryl Murphy, from Aviva Investors, had the following to say about the model:

"[In terms of funding,] we would look at aggregation of projects for higher scale. The role of the NZDV is pretty key here [as] it helps me look at a holistic package."

Darryl Murphy, Managing Director, Infrastructure, Aviva Investors